2025 Household Tissue Consumption Trends in China

1. Overall Market Performance Comparison

During Singles’ Day (Double 11) 2025, total e-commerce GMV across China reached RMB 1.695 trillion, up 14.2% year-on-year. This growth was slower than the 26.6% increase recorded in 2024. As a high-frequency FMCG category, household tissue showed clear structural divergence rather than uniform growth.

1.1 Volume vs. Value Growth

In 2025, overall tissue sales volume rose slightly compared with 2024, but the growth rate softened. JD.com data shows that household tissue GMV in the first week of Double 11 2025 increased by 52% YoY. Category performance differed sharply:

- Cotton soft wipes (cotton tissues): GMV up 286% YoY

- Lotion / cream tissues: GMV up 137% YoY

- Flushable wet toilet paper (wet wipes for toilet use): GMV up 58% YoY

This was a major acceleration compared with wet toilet paper’s 11.5% value growth in 2024.

1.2 Pricing and Promotion Shifts

Overall pricing for household tissue in 2025 stayed stable with a mild decline. Large-pack formats delivered clearer price advantages.

- Example: Vinda rolled tissue dropped from RMB 1.49/roll (2024) to RMB 1.18/roll (2025).

- Deyou wet toilet paper used “flushable dispersible” functionality for premium differentiation. Its upgraded 2025 version was 30% thicker than standard products, yet still priced below RMB 0.17 per sheet, keeping affordability while raising perceived value.

1.3 Consumer Behavior Changes

In 2024, buyers mainly focused on basic use cases and stocked up on traditional products such as toilet rolls and boxed facial tissue.

In 2025, consumers displayed a strong “precision paper usage” trend:

- 70% of consumers preferred specialized tissue paper for different needs.

- Nearly 30% of households owned more than 10 types of paper products.

This marks a major upgrade from basic daily necessity to emotion-driven necessity, where comfort, lifestyle fit, and user experience matter as much as utility.

2. Evolution of Best-Selling Sub-Categories

2.1 Double 11 2024 Best-Sellers

Wet toilet paper was the top breakout category in 2024. From Dec 2023 to Nov 2024, its total sales value across major platforms reached RMB 3.05 billion, up 11.5% YoY. Sales volume hit 87.176 million packs, up 25.5% YoY.

- Deyou led the category with 35.9% market share.

- Vinda ranked second at 10.1% share.

Traditional toilet rolls and facial tissue remained high-volume core consumables. Brands like Qingfeng and Xinxiangyin sustained stable sales via large-pack, high-value bundles.

2.2 Double 11 2025 Best-Sellers

In 2025, best-selling tissue categories shifted noticeably:

1) Lotion/Cream Tissues (Moisturized Paper)

A “super dark horse.” User growth in 2024 already climbed 114% YoY, and demand surged again during Double 11 2025.

- 54.2% of consumers prioritized softness.

- 55.6% focused on materials and ingredients.

- Kexinrou V9 became widely known as a premium “nose-care tissue,” turning into a household staple.

2) Hanging Facial Tissue (Wall-Mounted Pull-Down Tissue)

This format reshaped cleaning routines through “invisible storage + multi-scene compatibility.”

Many brands entered the space. Vinda expanded aggressively starting 2024, and its 2025 YTD growth significantly exceeded industry averages.

Promotion data from “Daily Flash Sale” indicates a single hanging-tissue SKU could sell 20,000+ packs per day.

3) Fragrance Wet Toilet Paper

Search volume rose 165% YoY. Brands such as Deyou drove upgrades by pairing hygiene with emotional comfort.

Key features include skin-friendly weak-acid pH, suitable for pregnant women and sensitive users (e.g., hemorrhoid sufferers).

4) Intimate Care Tissue & Cleansing Products

Private-care cleansing mousse grew over 100%.

Male demand expanded sharply:

- Searches for male intimate wash reviews jumped 11,951% YoY.

- Men now represent over 18% of private-care consumers.

The market is transitioning from “female-only demand” to “shared gender demand.”

2.3 Three Core Trend Shifts (2024 → 2025)

- From single function to blended experience

Wet toilet paper evolved from a “special-occasion product” to a high-frequency necessity.

About 70% of users believe its performance differs strongly from dry tissue, and view it as a “quality investment” in personal hygiene. - From basic care to niche scenarios

Lotion tissues moved beyond the maternal/infant niche into broader “self-care and comfort” usage.

Customer segments now include refined lifestyle users, large rhinitis populations, and sensitive-skin consumers. - From traditional goods to eco-innovation

Bamboo pulp paper, biodegradable wipes, and other sustainable products performed strongly, reflecting rising eco awareness.

3. Consumer Psychology and Behavior Drivers

3.1 Emotional Value as a Purchase Engine

Consumers increasingly treat tissue as a lifestyle medium, not only a utility product.

- Design & Aesthetic Demand: The topic “tissue color matching” on Xiaohongshu exceeded 100 million views, showing stronger packaging and style expectations.

- Brand Story & Emotional Connection: Vinda cooperated with Dongfang Zhenxuan on a “forest healing” gift box. It sold out 100,000 sets in 10 minutes.

- Scenario-Based Emotional Satisfaction: Deyou promoted “stress-relief cleaning,” pushing toilet foam and bathroom foam searches up 1460% and 282% respectively. Consumers want a visually soothing cleaning experience.

3.2 Growth in Lower-Tier Markets

Consumption in lower-tier cities and counties expanded rapidly.

- Historical baseline: In a 2019 Juhuasuan bamboo tissue campaign, 66% of buyers were lower-tier users; by 2025 this share grew further.

- Regional momentum: On Pinduoduo and Douyin e-commerce, boxed tissue GMV in tier-3/4 cities and counties rose 41.2% and 52.7% YoY, far outpacing top-tier cities.

- Lower-tier consumers now treat premium tissue not as optional, but as necessary, pushing the industry toward quality + functionality + sustainability.

3.3 Segmentation and Personalization

Market demand is increasingly layered.

- Premium segment: Products priced above RMB 15/pack grew from 12% of sales (2020) to 27% (2023). Users accept premiums for added functions.

- Regional brand rise: Regional brands raised share by 9 points vs. 2020, reaching 34%, helped by localized service and customized SKUs.

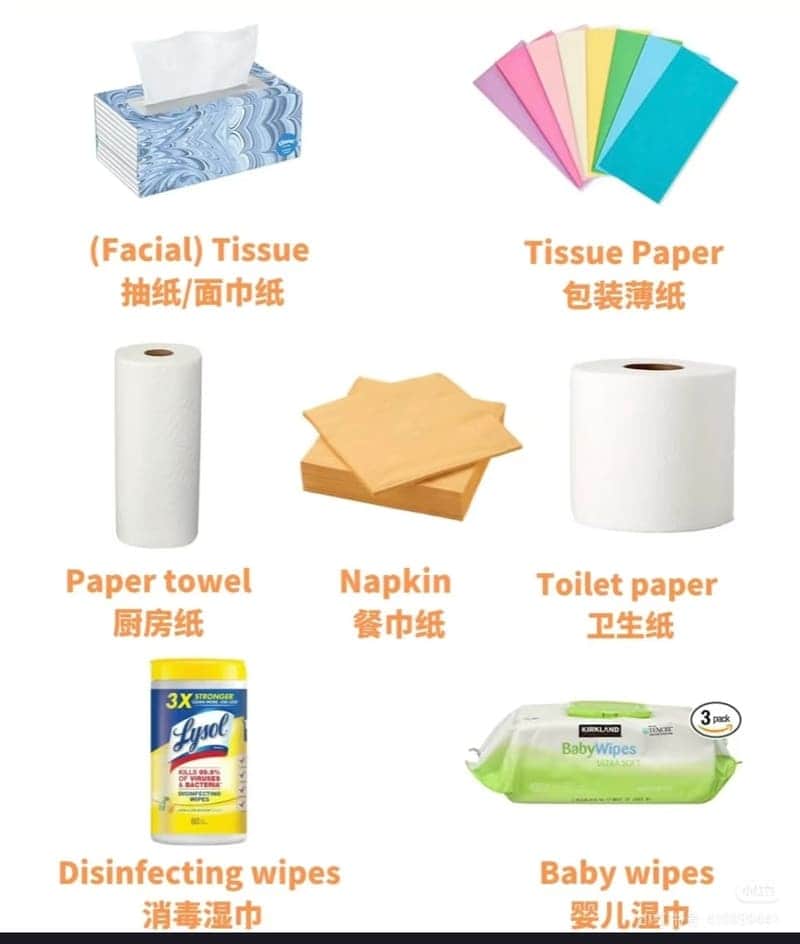

- Scenario-specific needs:

- Kitchen tissue splits into heavy-oil cleaning, light-oil wiping, and food handling tiers.

- Baby wipes developed by growth stage; 0–1 year SKUs can carry 25% price premiums.

4. Future Trends and Business Opportunities

4.1 Acceleration in Eco Materials

Bamboo pulp tissue is a rising blue-ocean segment.

- 2025 bamboo “natural color” tissue market size is expected to hit RMB 8 billion, with ~7% CAGR.

- Bamboo tissue already accounts for 60% of the natural-material segment.

- Bamboo pulp substitution rate is forecast to grow from 15% (2024) to 35% (2029).

Biodegradable packaging and green certifications are becoming key differentiation tools.

- Leading companies now track carbon footprints across 95% of product lines.

- Certified green products can achieve ~20% premium pricing.

- Qingfeng launched a 30% bagasse-mixed wood pulp tissue, reaching 90%+ biodegradability.

4.2 Deeper Scenario & Function Segmentation

Customized tissue for specific scenes will be a main growth driver.

- Kitchen and wet toilet paper penetration in tier-3/4 markets is projected to rise 6.8 points per year, forming a RMB 28 billion emerging category in 2025.

- Functional innovation is speeding up: tissues with natural moisturizers or nano-antibacterial tech expanded their market share 3× in three years.

- Example: JieRou antibacterial wet wipes passed SGS certification (99% bacteria inhibition), serving hospitals and postpartum centers.

4.3 Technology-Driven Industry Upgrade

Automation and AI will reshape cost structure and competition.

- Industry automation reached 68% in 2024 and is expected to exceed 85% by 2029.

- Advanced machines (TAD tissue lines, magnetic-levitation paper machines) push the sector into efficiency-based competition. Automated lines reduce unit energy use by 15% and raise pass rate to 99.8%.

- AI visual inspection systems can monitor 20+ quality metrics in real time and cut complaint rates to below 0.03%.

- Smart dispenser feedback systems can reduce replenishment management cost by 30%.

4.4 Channel Down-Tiering and Regional Expansion

Lower-tier markets will remain the core growth engine.

- Urbanization in central and western regions is projected to drive ~12% annual growth.

- Some brands using county-level warehouse integration achieved 300%+ down-tier channel growth in provinces like Sichuan and Henan.

- Logistics down-tiering lifted county coverage to 92%.

- In 2024, rural tissue consumption grew 15.7%, surpassing urban growth of 11.2%, showing strong rural upscaling momentum.

4.5 Emotional Branding and Differentiation

A combined model of high-frequency consumption + emotional value + eco premium will dominate.

Brands should strengthen differentiated positioning, for example:

- “Gentle-care series” for baby/maternity

- “Silent pull tissue” for office and hotel scenarios

Word-of-mouth content marketing will matter more. Leveraging UGC and reputation tools can lift NPS significantly. One brand improved NPS from 70 to 90 through structured social engagement.

5. Conclusion & Outlook

The 2025 Double 11 tissue market clearly moved from basic necessity to emotion-driven necessity. Upgraded consumer psychology is reshaping category demand and product structure. Over the next five years, China’s household tissue industry is expected to maintain 7–9% CAGR, potentially exceeding RMB 300 billion by 2029.

Competition will show a “head-brand consolidation + niche breakout” pattern:

- Leading players (Vinda, Qingfeng, Xinxiangyin) may secure 60%+ share of mid-to-high-end markets through integration.

- Regional brands will hold 15–20% share by focusing on localized and customized offerings.

Three transformative shifts are accelerating:

- Traditional products → eco-innovation

- Basic functions → scenario solutions

- Price wars → quality plus emotional value

Implications for Brands Preparing for Double 11 2026

- Invest further in eco-materials to lift premium capability.

- Expand scenario-specific SKUs and functional innovation.

- Optimize supply chain and down-tier channel deployment.

- Strengthen emotional branding through content and user experience.

If you are looking for a reliable and affordable supplier of tissue paper jumbo rolls, Yuanhuapaper is your excellent choice. We offer 100% virgin wood pulp tissue paper parent reels, which are the premium tissue raw material for making toilet paper, facial tissue, napkins, and hand towels. You can choose from a range of paper gramms and paper players options to suit your tissue machinery.