Paper Price Hikes! Companies Raise Prices Every 3 Days While Paper Mills Halt Production

Recently, the price of paper has become a focal point of public attention, starting with the “nationwide tissue paper price increase” trending on social media. Recently, cultural and packaging papers have also seen significant price increases. What exactly is happening?

White Cardboard Prices More Than Double, Printing Shop Profits Sharply Reduced

Liu Shuangxi, the owner of a print shop, has been quite busy with decent business, but he is troubled by the recent price increase of cultural paper. He noted that since the Spring Festival, the price hikes have been substantial. For instance, the price of white cardboard has risen from 6,500 yuan/ton to between 13,000 and 14,000 yuan/ton.

Liu Shuangxi stated that while paper prices keep rising, printing prices have remained unchanged, leading to a reduction in profits by nearly 30%.

Since May, major domestic cultural paper companies and traders have issued multiple price increase notices, with cultural paper generally rising by 200 yuan/ton and white cardboard by 1,000 yuan/ton.

Paper Prices Competing with Pork Prices

Recently, the surge in paper prices has almost reached the level of pork prices, leading to “three consecutive price hikes” for household paper within a month. Many netizens have commented, “Quickly stock up on toilet paper!”

Zhang Siwa, a wholesaler from Neijiang, Sichuan Province, buys paper from a factory at dawn and then sells household paper in town, earning a margin. However, due to the factory’s price hikes, Zhang Siwa says the profits are too low to continue.

Unlike ordinary wholesalers, the prices of household paper in large supermarkets remain relatively stable. In a chain supermarket in Beijing, sales personnel indicated that the prices of all household papers have not changed for now. Zhang Guangping, a non-food procurement expert at Hema, explained that due to substantial stock and long-term supply agreements with manufacturers, short-term price increases for household paper are unlikely.

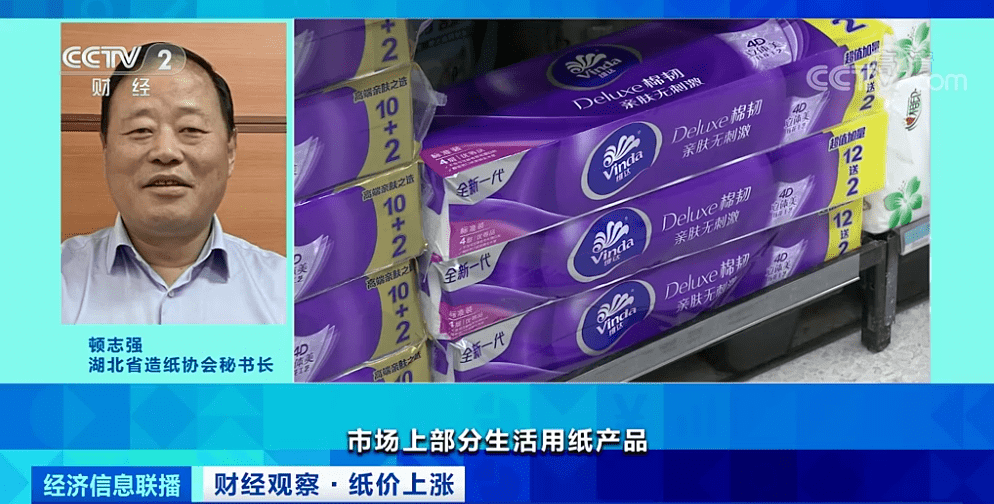

However, Zhang Guangping noted that with the major household paper companies Jin Hongye, Hengan, Vinda, and Zhongshun Jierou issuing price increase notices in April, it is uncertain when the retail prices might be adjusted.

Rise in Living Paper Prices

According to Duan Zhiqiang, Secretary-General of the Hubei Paper Industry Association, the ex-factory prices of some household paper products have increased by 10-20%.

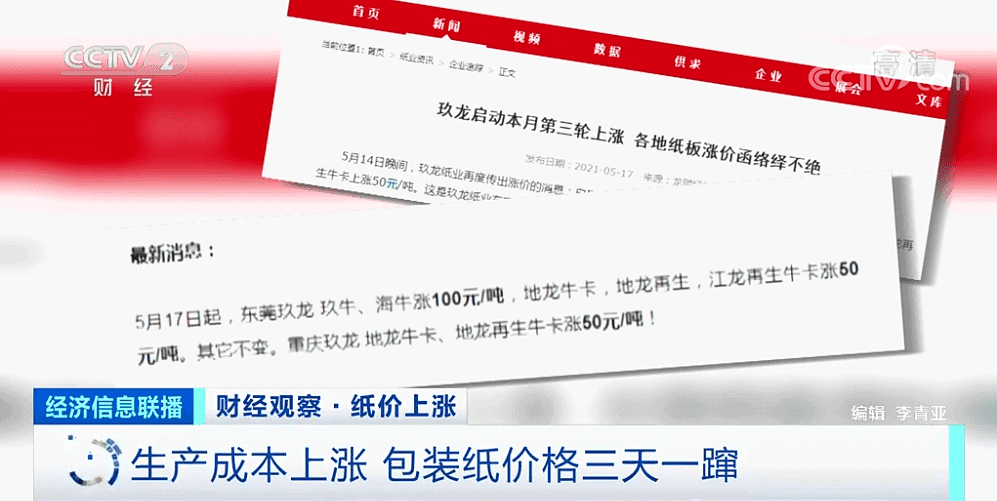

Not only have household paper prices increased, but also on May 17, Nine Dragons Paper, the leading packaging paper company in China, initiated its third price hike in May, raising the price of base paper approximately every three days. Along with Nine Dragons‘ price increase, the cardboard market has also seen a new round of price hikes, with many cardboard factories implementing a second round of increases.

Reasons Behind the Price Increases

Zhang Shenjin, Secretary-General of the All-China Federation of Industry and Commerce Paper Industry Chamber of Commerce, pointed out that the main reasons are global increases in the prices of upstream materials such as pulp, logistics, and energy, which directly raise production costs. The current price increases are based on previously lower prices, especially for white cardboard, which has seen substantial hikes.

Pulp Prices Exceed Paper Prices, Leading to Production Halts

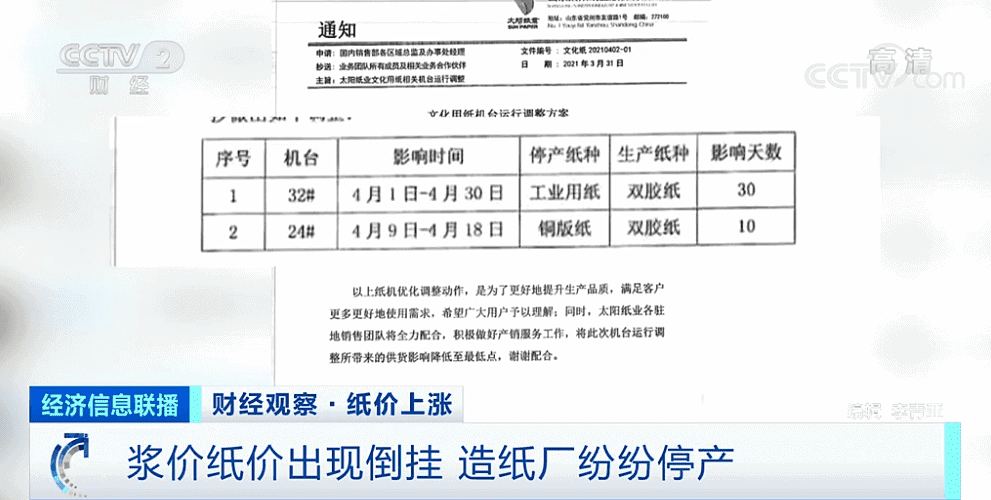

Despite the paper industry’s substantial profits amid the price hikes, many paper companies have suddenly announced production halts for maintenance since March. For example, on March 31, Shandong Sun Group announced optimization adjustments for industrial paper and coated paper machines in April. On April 26, Shandong Huatai Paper issued a notice about halting production for maintenance of coated paper machines in early May. On April 27, Chenming Paper decided to halt production for ten days in mid-May for maintenance of cultural paper machines.

During these production halts, their first-quarter financial reports have been remarkably strong. For instance, Chenming Paper’s net profit in the first quarter was 1.179 billion yuan, up 481.42% year-on-year, while Sun Paper’s net profit in the first quarter was 1.108 billion yuan, up 106.71% year-on-year. So, why are these companies announcing production halts amid rapid profit growth?

Impact of Rising Pulp Prices

According to Zhang Shenjin, the reason for the production halts is the rise in pulp raw material prices, which has led to a situation where pulp prices exceed paper prices, forcing some paper mills to halt production.

The increase in pulp prices is closely related to demand. In the first quarter, the Manzhouli port imported 70,000 tons of pulp, up 37% year-on-year, valued at 260 million yuan, up 42.1% year-on-year. Since 2003, China’s pulp imports have ranked first globally, with increasing demand. In 2020, the import volume of wood pulp reached 30.64 million tons, accounting for 72.8% of the total consumption of wood pulp. Furthermore, the price of wood pulp has been rising continuously. From July last year to March this year, the average price of wood pulp increased by over $400/ton.

Filling the Raw Material Gap with Domestic Waste Paper Recovery

The rising pulp prices have put considerable pressure on paper companies. Simultaneously, with the implementation of China’s ban on solid waste imports, the import quota for waste paper has been reset to zero. Facing a huge gap in recycled fiber, Chinese paper companies have started various measures to enhance the supply of pulp raw materials.

In April 2021, the average factory price of domestic yellow board paper was 2,140 yuan/ton, up about 25% year-on-year. Industry insiders attribute this rise in waste paper prices to the increase in pulp prices and the implementation of the waste ban, leading to growing demand for domestic waste paper.

Efforts to Increase Domestic Raw Material Supply

According to Tang Yanjun, Secretary-General of the Waste Paper Branch of the China Recycling Resources Recycling Association, the rise in domestic waste paper demand will significantly improve the quality and recovery rate of domestic waste paper.

Currently, China’s waste paper recovery rate has reached 90%, surpassing that of Japan, Europe, and other developed countries, but a huge gap still exists.

Encouraging Overseas Waste Pulp Production

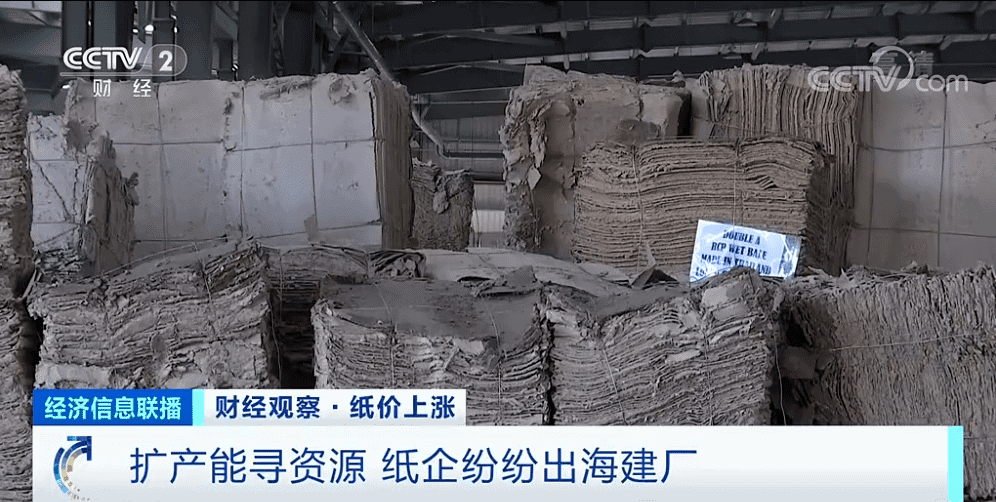

Zhang Shenjin mentioned that to address the shortage of waste paper and waste pulp, it is necessary to enhance overseas waste pulp production capacity and encourage Chinese companies to build waste pulp processing plants overseas.

In a paper factory in Zhejiang, besides imported waste paper and domestic waste paper raw materials, there is also a gray cardboard, which is imported recycled pulp processed from waste paper abroad and then imported as semi-finished pulp. This year, the company has established a production facility in Southeast Asia for recycled pulp, which is now operational.

Strategic Overseas Expansion by Leading Chinese Paper Companies

Currently, some leading Chinese paper companies are trying to expand capacity in countries rich in forest resources. Nine Dragons Paper has acquired two paper mills and pulp mills in the United States and built a paper production capacity of 1.6 million tons in Vietnam. Shanying Paper has acquired or holds stakes in several pulp and paper mills in Sweden and Norway. Sun Paper has built new paper and pulp mills in Laos and planned a 100,000-hectare pulp forest project to ensure a stable supply of raw materials to produce the paper parent rolls.

Utilizing Bamboo for Sustainable Production

To increase foreign raw material sources like paper pulp, China also needs to continuously enhance its own raw material supply. Developing papermaking raw materials has become a new challenge for the industry. In Sichuan, bamboo, due to its short growth cycle and rapid forest formation, has become the best raw material for tissue paper production, forming a path of circular economy that benefits multiple parties.