China’s Paper Market Situation and Global Hardwood Pulp Market Outlook in 2023

The theme of this year’s conference is “Power and Pressure”, and when it comes to this theme, first of all, I heard from the Secretary General that the number of participants this year has set a new record, and from this level it also shows that people really want to know about the current situation of the pulp and paper industry and the trend of the future development of the pulp and paper industry. I will spend about 20 minutes to illustrate the current situation of the Chinese and global paper market and its medium- and long-term development trends, as well as the impact it will have on the upstream pulp industry. I hope this information will be helpful to everyone here.

First look at the big picture macroeconomic situation. I will briefly state our views, and there are experts in economics on today’s agenda, Prof. Shi and Prof. Zhang, to give you a more detailed analysis. Overall, after the epidemic, the economy is recovering globally, and the mainstay of that recovery many people are looking at China.

In the past, it was said that China is the locomotive of the world’s economic growth, and looking at it this way, the country has set a target of 5% growth by 2023, and there is a high probability that it will have a chance to break through 5%. At the same time in the premise of China’s economic recovery, we also need to see some of the traditionally economically developed regions of the United States, Europe, the situation is not very optimistic. We all know a few things that have happened recently, non-stop interest rate hikes, banks one by one have some difficulties, so the uncertainty is still there. In addition to China’s economic recovery, some other developing countries, such as India, Indonesia’s economy is still dynamic, basically will have more than 5% growth, which will bring some opportunities for our pulp and paper industry.

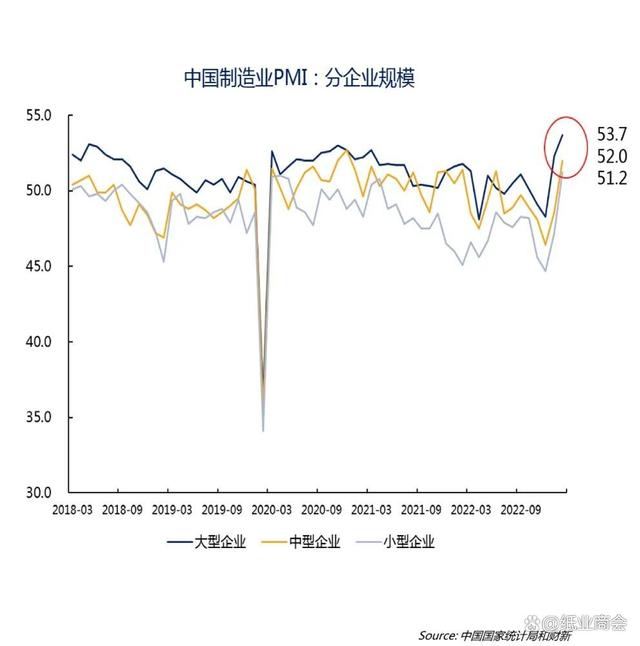

Focus again on China. Everyone here knows the PMI, whether it is the National Bureau of Statistics manufacturing data, financial data, or the following chart of large, medium and small enterprises in the manufacturing index, the first few months of this year are more than 50%, which is a relatively healthy growth trend, which is good. We have also heard that China is facing some difficulties, especially on the export side, and we hope that exports will recover gradually from the second quarter onwards. It’s not a quick recovery, but a gradual recovery should be the probability, and it will gradually improve the demand of our manufacturing industry.

I don’t need to go into detail about the recovery of consumption, everyone here may have personal experience, it’s hard to book dinner, it’s hard to buy high-speed rail tickets and air tickets sometimes, and the hotels are often full, no matter whether it’s a business meeting or an exhibition, it’s true that people’s activities are obviously more. So everyone should have some confidence in the recovery of the economy.

What will be the impact of the above situation on paper and paperboard in 2023? Let’s first look at the production of paper and paperboard made from wood pulp. We estimate that the growth rate in 2023 will be about 7%, and the production will rise from about 47 million tons to about 50 million tons. Of that, domestic demand will rise from 41 million tons to 44 million tons, and exports will fall slightly, and China’s exports are really in trouble. And commodity exports encountered obstacles, then used for commodity exports of packaging, instructions, promotional items of paper relative will be affected to a certain extent, exports have to cheer.

Look in more detail, I take two more representative index to do some analysis. First look at the cultural paper index, we estimate that 2023 than 2022 can probably grow more than 1.1 million tons. Both the capacity side of the drive, more importantly, the demand side of the drive. We all know that the introduction of national favorable policies, including teaching aids and textbooks require a larger word, line spacing to be a little larger, in order to facilitate the children’s healthy reading, etc., all of which will bring an increase in the amount of paper. The “two sessions” has just finished, the national policy documents printing also have demand, recently there are a lot of new publishers tenders will be introduced, although there are some prices have not been set, but the demand is certainly in, all these factors will be for the year 2023, the cultural paper, double-gummed paper demand to bring growth.

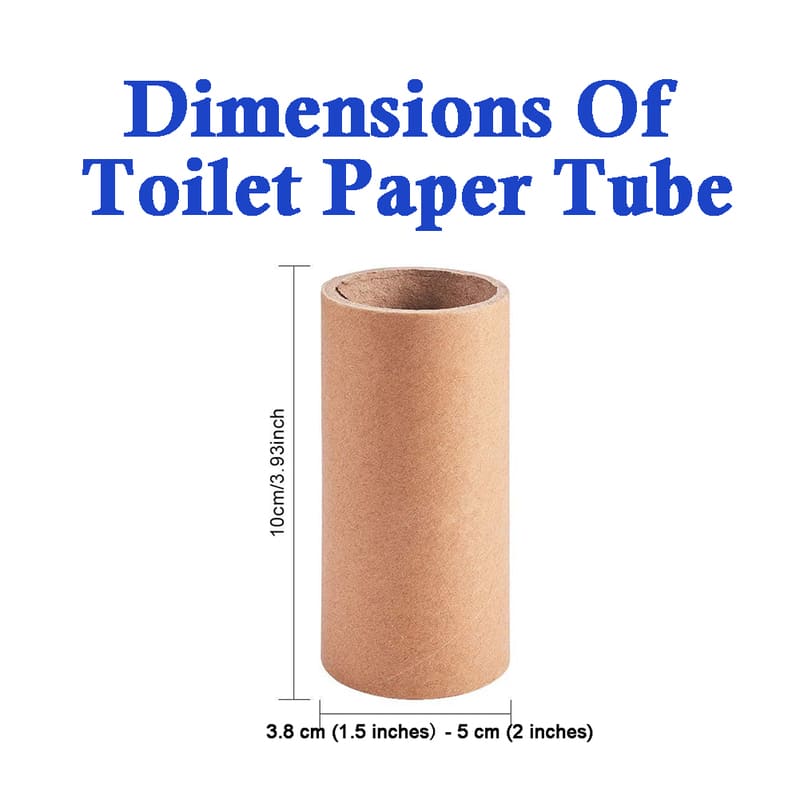

Household paper is another representative segment. According to the household paper committee last year’s information, Chinese people use an average of 8.4 kilograms of household paper per year, 2023 is estimated to rise to 8.8 kilograms. But in developed countries generally average more than ten kilograms, and some countries even more than 20 kilograms. But the level of 8.8 kilograms will also give this year a substantial increase in space.

I cited a typical example, Baoding is the life of the paper industry is concentrated in the region, 2022 start rate is quite low, which has a lot of factors. 2023 after the opening, the local start rate even more than 80%. The recovery of the economy and the increase in travel has brought demand for household paper scenes outside the home. So overall, demand for household paper in 2023 is expected to grow by a minimum of 800,000 tons.

Having said that about paper, let’s take a look at pulp. We estimate that demand for commodity broadleaf pulp will grow by about 1.9 million tons in 2023 compared to 2022 due to the increase in downstream paper and paperboard capacity and demand. Now a lot of this is projected new capacity, how much pulp will actually be produced and shipped to China in 2023? According to some industry figures, it could be around 2.5 million tons. Pulp industry every year will encounter some unplanned shutdowns, all kinds of accidents, all kinds of emergencies, if these factors are taken into account, the real demand, China is about 1.9 million tons, plus other developing countries about 400,000 tons, basically belongs to the balance of the state. People often say that the pressure is great, but quietly and carefully analyze, may be more psychological factors. From the actual data, pulp upstream and downstream is still in a state of basic balance.

Unless the planned shutdown, there are larger level factors, such as geopolitics and the impact of some other unexpected events. This year has just begun, Finland has been a strike, Chile has been a fire, Russia’s sanctions have affected a lot of countries can not be used in Russia’s exports of any product, a lot of pulp mill shutdowns, or even closed, these uncertainties will have a certain impact on the global pulp supply chain.

Looking longer term, from a global perspective, if the main growth areas of the global pulp and paper industry are developing countries, then China’s growth will be the largest. Some other developing countries in Asia will also grow, but Europe and the United States and Japan will be a gradually declining trend. By paper type, household paper is still rising. If you look at the long term, ten years, twenty years, household paper is still a paper type with development potential. As people’s living standards continue to improve, packaging paper types will also show a good development trend.

Then look at China. If you look back a few more years from 2022 to 2026 by paper grade, our analysis suggests that China’s real paper and paperboard production from pure wood pulp as raw material is expected to rise from 47 million tons in 2022 to about 57 million tons in 2026. One of the following areas will increase faster, one is cultural paper, which is the traditional double-gum paper; the second is white cardboard, including Asia Symbol will also have white cardboard capacity put into production. Packaging paper, although exports are currently frustrated, and then there is living paper, these three large paper types are expected to have a considerable amount of growth in the next few years. The packaging industry has been affected to some extent, but in the long run, packaging is still a segment with growth potential.

Look again at the growth in global demand for commodity pulp. China’s 2022 demand for broadleaf commodity pulp is 15 million tons. By 2026, it will probably reach 19 million tons. And globally, demand for broadleaf commodity pulp is expected to rise from 37 million tons now to 42 million tons in 2026, which is about 5.1 million tons of growth. Speaking of capacity growth, we estimate that by 2026 global broadleaf pulp will increase by about 4.9 million tons. If you remember what I mentioned on the previous page, the demand growth is probably around 5.1 million tons. So, looking at the big picture, not the immediate future, and looking back a few years, the supply and demand for real commodity pulp is still in a basic balance.

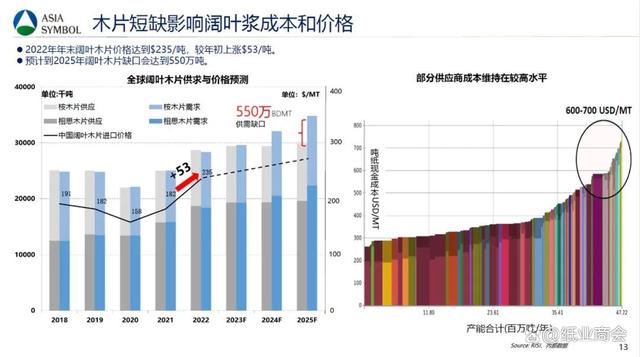

Recently added so much new pulp production capacity, where does the wood chips come from? Production of broadleaf pulp, each ton to be roughly 1.8 tons to 2 tons of wood chips, the production of dissolving pulp, the amount of wood chips required even more, do we have enough wood chips supply? In the pulp industry, in 2022, the price of wood chips increased by more than 50 U.S. dollars a ton, the highest time reached more than 230 U.S. dollars a ton, and the current price of wood chips has slightly decreased. Because of the increased demand, there will naturally be some shortage in supply.

We have also done a medium-term analysis, according to our estimates, to 2025, if in accordance with my previous global pulp new production capacity data for analogous analysis, then, in the global scope of wood chips used for papermaking, the gap between supply and demand of about 5.5 million tons, that is, there will be a shortage of more than 5 million tons of wood chips per year, the most direct impact is that the cost of wood chips will rise, the manufacturing cost of our pulp enterprises will also be The most direct impact is that the cost of wood chips will rise, and the manufacturing cost of our pulp enterprises will also have an indirect impact.

The following is a summary. Economic recovery is certain, but at different stages, the speed of recovery is not the same, in different countries and regions are not the same, China will still be the main driving force of the national economic recovery. Various uncertainties, including geopolitical influences, will still bring some uncertainties to our supply chain. It’s been a period of time when containers are better to find and logistics costs have dropped significantly, and that’s the status quo. Once something pops up, there could be some drastic changes again soon. We as a production-oriented enterprises, pulp is used for production, not for speculation, so we still need to stable production, stable supply as a prerequisite. If the paper type to be divided, the probability is that the growth of cultural paper and household paper these two paper will be relatively good. 2023, China’s broadleaf pulp demand in the world is about 5.1 million tons, of which more than 3 million tons are from China, the global broadleaf pulp market supply and demand balance plays a very important role. If you are here to consider pulp fluctuation is too strong, hope to do some pulp themselves, then do some feasibility studies, the supply of raw materials, especially woodchip resources to do a good job of planning, planning, research, because these may really affect the final cost of the enterprise.

The world’s major broadleaf pulp producers production costs above $600, probably accounting for about 10% of global pulp production capacity. Some pulp producers may face problems if pulp prices continue to fall.

The final conclusion, the pulp and paper industry, although the pressure faced by everyone has a consensus, but in the medium and long term, there is still a very good development trend, I hope that all the peers here can take advantage of the opportunity of the Pulp Week to communicate more, share more, we work together, and together to promote the pulp and paper industry’s healthy and sustainable development.